What Most Small Businesses Get Wrong About Digital Marketing Tax Deductions

Digital marketing expenses such as websites, SEO, hosting, Google Ads, and social media ads are typically deductible, helping small businesses reduce taxable income and support growth. This content is educational only and not tax advice.

TLDR

- Most digital marketing expenses are deductible business costs

- Websites, SEO, PPC, and content often qualify

- Federal tax rules apply nationwide

- Some development costs may be treated differently

- Deductions reduce taxable income, not total spend

- Documentation is critical

Here is the truth. Many small business owners assume digital marketing is optional. What they miss is that skipping it can mean fewer customers and higher taxes at the same time.

One quick reality check before you start categorizing deductions: affordable marketing only works when the scope stays controlled. If your plan involves constant pivots, multiple decision makers, or random third-party edits, your costs go up fast. If you want the exact breakdown of what our monthly model includes (and what it does not), read What You Get (and What You Don’t) with Our Affordable Digital Marketing Model.

Why Digital Marketing Expenses Usually Qualify

Federal tax law allows businesses to deduct expenses that are both ordinary and necessary for operating a trade or business. Advertising and marketing meet this standard in modern commerce when they are reasonable and directly connected to business activity.

What the IRS considers ordinary and necessary

Under Internal Revenue Code Section 162, businesses may deduct ordinary and necessary expenses incurred in carrying on a trade or business, including advertising.

The IRS further explains deductible advertising and marketing costs in IRS Publication 334, the primary federal guide for small-business deductions.

Digital Marketing Expenses That Commonly Qualify

Based on IRS and SBA guidance, many digital marketing costs qualify as deductible business expenses when they are reasonable and used to promote or support business operations.

Commonly deductible digital expenses

| Expense | Deductible? | Notes |

| Website design and development | Yes | When used to promote or support the business |

| Website hosting and domains | Yes | Ongoing operating expense |

| SEO services | Yes | Treated as advertising or marketing |

| Google Ads and social media ads | Yes | Fully deductible advertising costs |

| Email marketing platforms | Yes | Marketing software and subscriptions |

| Branding and graphic design | Yes | Logos and promotional materials |

| Political advertising | No | Generally not deductible |

The Small Business Administration reinforces this guidance in its Business Expenses Guide, which outlines common deductible costs for small businesses.

What Marketing Costs Are Not Usually Deductible

Some expenses are not deductible, even if they are marketing-related. Costs that are personal, political, or not directly tied to operating a business can cause uncertainty. Clarifying these helps small business owners feel more secure in their choices.

- Political advertising and lobbying

- Personal social media promotion

- Hobby activities that are not a true business

- Unreasonable or excessive expenses

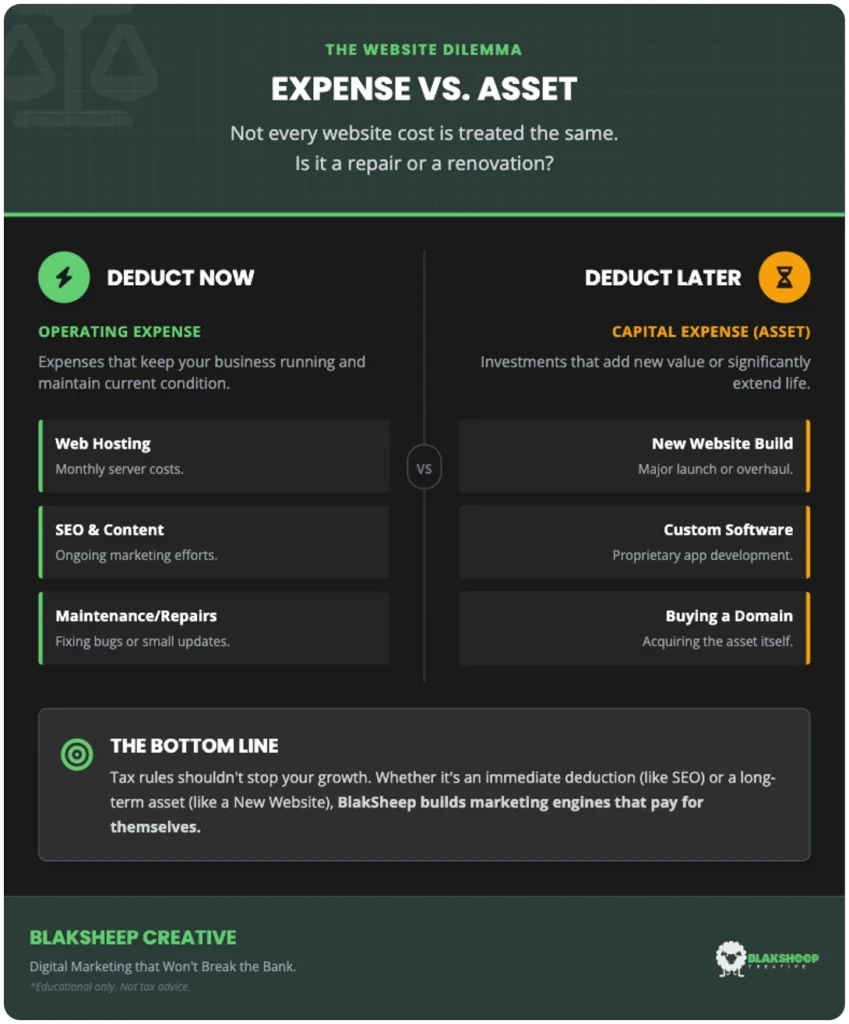

Capitalized Costs vs Immediate Deductions

Some marketing costs may need to be capitalized rather than deducted immediately. Large website builds or software-like platforms with a useful life beyond one year may be treated as assets and deducted over time instead.

Some marketing costs may need to be capitalized rather than deducted immediately. High-value custom projects or software-like platforms with a useful life beyond one year may be treated as business assets and deducted over time instead.

This distinction depends on the facts and circumstances of the project and should be reviewed with a qualified tax professional before filing. Seeking expert advice can provide peace of mind and confidence in your deductions.

A Real-World Small Business Example

One service-based business relied heavily on referrals and invested in a new website, SEO, and online ads. Within months, they kept invoices and detailed records. Proper documentation allowed them to categorize these costs as marketing expenses, reducing taxable income and increasing revenue.

Thinking about investing in a website or digital marketing this year?

If you’re going to spend money on your online presence, it should actually work for your business. Our By-The-Month Website programs are built for small businesses that want a professional website, ongoing improvements, and consistent support over time.

The program runs on a 12-month commitment because real results come from steady execution, not one-off builds. No upfront website shock. Just a smarter, predictable way to invest in your online presence as part of running a serious business.

What a Tax Deduction Does and Does Not Do

A deduction does not make marketing free. It reduces taxable income. Businesses still pay for marketing, but deductions lower the effective cost and reduce the financial risk of investing in growth.

What a Tax Deduction Does and Does Not Do

A deduction does not make marketing free. It reduces taxable income. Businesses still pay for marketing, but deductions lower the effective cost and reduce the financial risk of investing in growth.

This tax reality reinforces the most important mindset shift for any business owner: Digital Marketing – An Investment NOT An Expense.

Frequently Asked Questions About Digital Marketing Tax Deductions

These are common questions business owners ask when evaluating whether digital marketing expenses are deductible.

Can small businesses deduct digital marketing expenses?

Yes. In most cases, digital marketing expenses, such as website development, SEO, and online advertising, are deductible when they are ordinary, necessary, and directly related to business operations.

Is a business website tax-deductible?

A business website is generally deductible when it is used to promote the business, generate leads, or conduct sales. Depending on the cost and usage, it may be deducted in the current year or capitalized over time.

Are Google Ads and social media ads deductible?

Yes. Online advertising costs are typically deductible when they are directly tied to promoting a business and are not personal or political.

Is SEO a deductible business expense?

SEO services are generally treated as advertising or marketing expenses and are commonly deductible when used to attract customers.

Want Help Getting Started the Right Way?

If you want a realistic digital marketing plan focused on ROI first and tax efficiency second, talk to a team that builds and markets websites for businesses nationwide.

This content is for educational purposes only and is not tax advice.